Introduction

In the realm of decision-making, humans are susceptible to various cognitive biases that can lead to erroneous judgments. One such pervasive mental model is the Gambler’s Fallacy. It refers to the mistaken belief that past events in games of chance, such as gambling or random events, influence future outcomes. Anchored in human psychology, the Gambler’s Fallacy holds significant relevance in decision-making processes, both in personal and professional contexts. This blog post aims to explore the Gambler’s Fallacy, its prevalence in our daily lives, examples of its occurrence, underlying biases, strategies to identify and avoid it, and the importance of being aware of this mental trap.

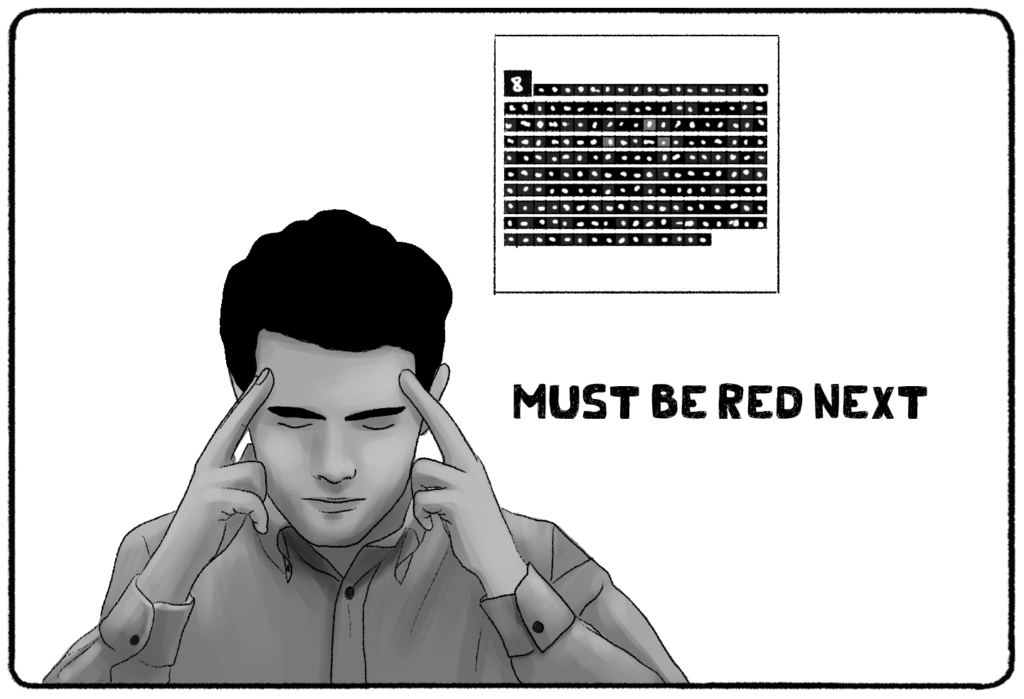

Understanding the Gambler’s Fallacy

The Gambler’s Fallacy is rooted in the erroneous assumption that a series of independent events will even out over time. For example, in a game of roulette, if the ball has landed on black several times in a row, individuals under the influence of the Gambler’s Fallacy may believe that red is “due” to appear soon. However, each spin of the roulette wheel is independent and unaffected by previous outcomes. This fallacy arises from a cognitive bias that leads individuals to perceive patterns or trends where none actually exist.

Prevalence in Daily Life

The Gambler’s Fallacy extends beyond the realm of gambling and permeates various aspects of our day-to-day lives. For instance, in personal life decisions, individuals may believe that if they have experienced a series of unfortunate events, their luck is bound to change soon. This fallacy can lead to irrational decisions based on the assumption that a streak of bad luck will be followed by a streak of good luck. Similarly, in business scenarios, individuals may make investment decisions based on the belief that if a product has been unsuccessful for a while, it is “due” for success. Public policy-making can also be influenced by the Gambler’s Fallacy, leading to misguided resource allocation based on the expectation that unfavorable outcomes will eventually be followed by favorable ones.

Examples of the Gambler’s Fallacy

- Personal Life Decisions: Imagine a person who has been single for an extended period. Under the influence of the Gambler’s Fallacy, they may believe that they are “due” for a romantic relationship soon and consequently rush into a relationship without considering compatibility or personal readiness. This fallacy can lead to dissatisfaction and further setbacks in their personal life.

- Business Scenarios: In the business world, the Gambler’s Fallacy can manifest when a company launches a series of unsuccessful products. Believing that a streak of failures will be followed by a streak of successes, the company may invest additional resources into a failing product, hoping for a turnaround without objectively assessing market demand or consumer feedback. This fallacy can lead to significant financial losses.

- Public Policy-Making: The Gambler’s Fallacy can influence public policy decisions, particularly in situations where policymakers believe that a series of unfavorable outcomes will naturally be followed by positive outcomes. This fallacy may result in persisting with ineffective policies, wasting resources, and overlooking necessary adaptations or changes in approach.

Biases Contributing to the Gambler’s Fallacy

Several cognitive biases contribute to the occurrence of the Gambler’s Fallacy

- Availability Bias: The availability bias occurs when individuals rely heavily on readily available information when making judgments. In the case of the Gambler’s Fallacy, individuals may focus on memorable instances of streaks or patterns and assign greater weight to them, ignoring the statistical independence of events.

- Illusion of Control: The illusion of control bias leads individuals to believe they have more control over random or chance events than they actually do. This bias can reinforce the Gambler’s Fallacy as individuals perceive their actions or decisions as influencing future outcomes, even in situations where events are truly random.

- Anchoring Bias: The anchoring bias influences individuals’ decision-making by placing disproportionate emphasis on initial information or reference points. In the context of the Gambler’s Fallacy, individuals may anchor their expectations to past events, assuming that future outcomes will conform to these anchors.

Identifying and Avoiding the Gambler’s Fallacy

- Understand Probabilities: Gain a solid understanding of probabilities and statistical independence. Recognize that each event is independent of past outcomes and that past results do not influence future outcomes in games of chance or random events.

- Diversify Decision-Making Factors: Consider a wide range of relevant factors when making decisions, rather than relying solely on past outcomes. Incorporate objective data, market research, expert opinions, and critical analysis to inform your decision-making process.

- Seek Feedback and External Perspectives: Engage with others who can provide objective feedback and challenge your assumptions. Surround yourself with diverse perspectives to counteract biases and gain a more comprehensive understanding of the situation.

- Track and Analyze Data: Keep track of relevant data and analyze trends objectively. By observing larger sample sizes and analyzing statistical patterns, you can make more informed decisions based on factual evidence rather than falling into the trap of the Gambler’s Fallacy.

Conclusion

The Gambler’s Fallacy poses a significant risk to objective decision-making, leading individuals to make irrational choices based on false perceptions of patterns or trends. By understanding the psychological biases that contribute to this fallacy, individuals can identify when they are prone to succumbing to it. Applying strategies such as understanding probabilities, diversifying decision-making factors, seeking feedback, and analyzing data can help individuals avoid the Gambler’s Fallacy and make more rational and objective decisions. Awareness and active avoidance of this mental trap are crucial for achieving optimal outcomes and minimizing the negative consequences of relying on illusory patterns in decision-making processes.