Introduction:

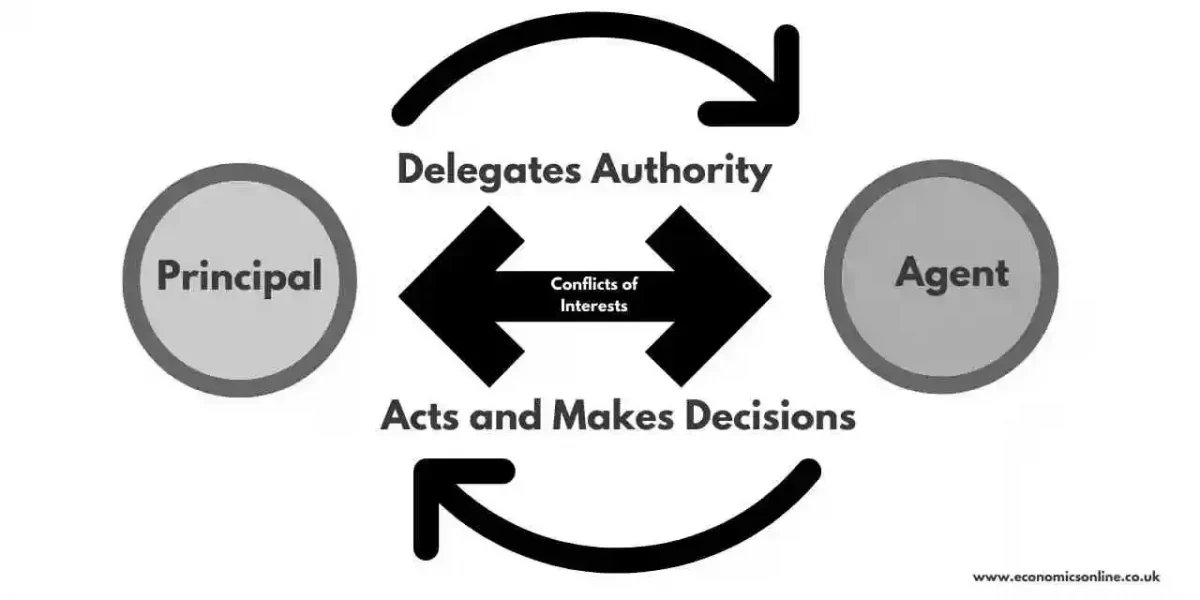

In the realm of decision-making, a fundamental challenge arises when one party, known as the principal, delegates authority to another party, known as the agent, to act on their behalf. This situation sets the stage for the Principal-Agent Problem, a concept rooted in human psychology that has profound implications for our day-to-day lives. The Principal-Agent Problem refers to the divergence of interests between the principal and agent, leading to conflicts and potentially irrational decisions that undermine the principal’s best interests. In this blog post, we will explore the significance of this mental model, delve into its various manifestations across different contexts, examine the psychological biases at play, and provide actionable strategies for avoiding this cognitive pitfall.

The Relevance of the Principal-Agent Problem in Decision-Making: The Principal-Agent Problem is pervasive and can be observed in a wide range of scenarios, from personal life decisions to complex business relationships and public policy-making. It emerges due to information asymmetry, where the principal has less information or expertise than the agent, and conflicts of interest, which can distort decision-making processes. By understanding this mental model, individuals can become more aware of the potential pitfalls they face when entrusting others with decision-making authority.

Examples of the Principal-Agent Problem in Various Contexts

- Personal Finance: A common example of the Principal-Agent Problem is the relationship between individuals and financial advisors. The principal seeks to grow their wealth and secure their financial future, while the agent’s interests may be skewed towards earning higher commissions or promoting financial products that benefit them personally. This misalignment can lead to biased advice, excessive risk-taking, or investments that are not in the principal’s best interest.

- Corporate Governance: The Principal-Agent Problem is often evident in the relationship between shareholders and corporate executives. Shareholders, as principals, aim to maximize the value of their investments, while executives, as agents, may prioritize short-term profits or personal gain. This conflict can result in unethical behavior, such as financial fraud or the prioritization of executive bonuses over long-term company performance.

- Public Policy-Making: In democratic systems, elected officials are entrusted with representing the interests of their constituents, acting as agents of the people. However, conflicts can arise when politicians prioritize their own agendas, party affiliations, or special interest groups, rather than the collective interests of the principal, the citizens. This can lead to policies that do not align with the needs and preferences of the electorate.

Psychological Biases Contributing to the Principal-Agent Problem: Several cognitive biases exacerbate the Principal-Agent Problem, influencing decision-making processes. Some of the most relevant biases include

- Agency Theory Bias: This bias occurs when agents prioritize their own interests over those of the principal. It stems from the psychological tendency to act in self-interest, seeking personal gains and benefits.

- Overconfidence Bias: Agents often display overconfidence in their abilities, leading them to make decisions that might not be in the best interest of the principal. This bias arises due to individuals’ tendency to overestimate their knowledge, skills, and chances of success.

- Information Asymmetry Bias: The unequal distribution of information between principals and agents can distort decision-making. Agents may exploit their informational advantage, intentionally withholding or manipulating information to further their own interests.

Strategies for Identifying and Mitigating the Principal-Agent Problem: To navigate the Principal-Agent Problem effectively, individuals should employ the following strategies

- Establish Clear Communication Channels: Open and transparent communication between principals and agents is crucial. Principals should clearly articulate their objectives and expectations, while agents should provide regular updates on progress and decisions made.

- Align Incentives: Aligning the incentives of agents with the interests of the principal can mitigate conflicts. For instance, tying executive compensation to long-term company performance can align the goals of shareholders and corporate executives.

- Monitor Performance: Principals should actively monitor and evaluate the performance of agents to ensure that their actions align with the principal’s best interests. Regular feedback, performance metrics, and performance-based incentives can enhance accountability.

- Seek Multiple Perspectives: Principals should gather input from multiple sources to gain a broader understanding of the situation. This helps reduce information asymmetry and provides a more comprehensive view of potential risks and opportunities.

Conclusion

The Principal-Agent Problem is a pervasive mental model that affects decision-making across personal, business, and public contexts. By understanding its dynamics, individuals can identify instances where conflicts of interest arise, leading to suboptimal decisions. Psychological biases exacerbate this problem, but through clear communication, aligned incentives, monitoring, and seeking diverse perspectives, individuals can navigate the Principal-Agent Problem more effectively. By actively recognizing and addressing this mental trap, individuals can make more informed decisions and protect their own interests in various spheres of life.