Introduction:

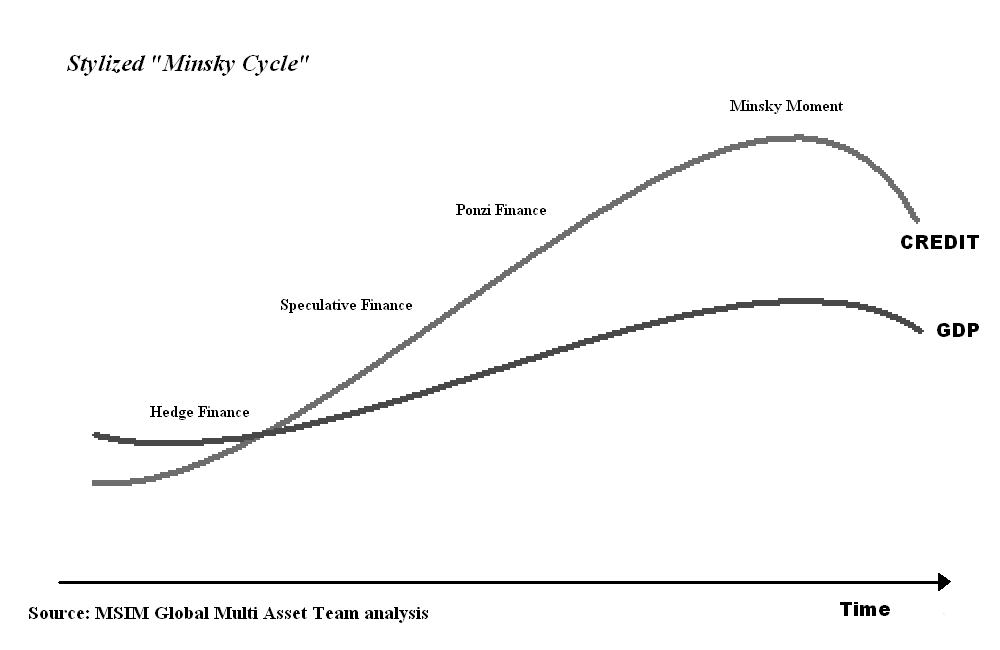

In the realm of decision-making, a critical turning point known as the Minsky Moment can have profound consequences. Coined by economist Hyman Minsky, this mental model refers to a sudden collapse or crisis that occurs when participants in an economy or market become overly optimistic and take on excessive risk. The Minsky Moment is anchored in human psychology, reflecting the cyclical nature of booms and busts in our economic systems. Understanding this model is crucial for recognizing and navigating the pitfalls of irrational decision-making. In this comprehensive blog post, we will explore the relevance of the Minsky Moment in decision-making processes, examine its prevalence in various contexts, delve into the mental biases that contribute to this phenomenon, provide practical strategies for identifying and avoiding this trap, and emphasize the value of awareness in decision-making.

The Relevance of the Minsky Moment in Decision-Making: The Minsky Moment is highly relevant in decision-making processes, especially in contexts where optimism, speculation, and risk-taking are present. This mental model sheds light on the inherent cycles of booms and busts in economic systems, emphasizing the need to recognize when optimism has reached unsustainable levels. By understanding the Minsky Moment, individuals and organizations can make more informed decisions and avoid the detrimental consequences of irrational exuberance.

Examples of the Minsky Moment in Various Contexts:

- Personal Finance: The Minsky Moment can be observed in personal finance when individuals become overly optimistic about the potential returns of investments, leading them to take on excessive debt or invest in speculative assets. When the market experiences a sudden downturn or correction, individuals who fell prey to the Minsky Moment may face financial ruin or significant losses.

- Real Estate Market: The Minsky Moment is often evident in the real estate market. During periods of economic expansion, rising property values and low interest rates can fuel optimism and speculation. Individuals and investors may take on excessive mortgages or engage in risky property development projects. However, when the market experiences a downturn or a burst of the housing bubble, the Minsky Moment reveals the vulnerability of those who overextended themselves.

- Business and Stock Market: The Minsky Moment can occur in the business and stock market when companies and investors become overly optimistic about future earnings and market conditions. Excessive risk-taking, such as high leverage or speculative investments, can lead to unsustainable growth. When economic conditions change, a sudden collapse can expose the fragility of those who ignored the warning signs of the Minsky Moment.

Mental Biases Contributing to the Minsky Moment:

Several cognitive biases contribute to the Minsky Moment, amplifying the cycle of optimism and risk-taking. Some prominent biases include

- Anchoring Bias: Individuals tend to anchor their beliefs and expectations to recent positive experiences or trends. This bias can lead to a distorted perception of risk and an underestimation of potential downturns.

- Overconfidence Bias: Optimism and overconfidence play a significant role in the Minsky Moment. People often overestimate their abilities, ignore potential risks, and believe they can predict or control the future with unwarranted certainty.

- Herding Behavior: The tendency to follow the actions and decisions of others, particularly during periods of market exuberance, can intensify the Minsky Moment. Individuals may fear missing out and engage in herd behavior, further fueling optimism and risk-taking.

Strategies to Identify and Avoid the Minsky Moment:

To navigate the Minsky Moment effectively, individuals can employ the following strategies

- Maintain a Balanced Perspective: Recognize that economic cycles and market fluctuations are inevitable. Avoid getting caught up in extreme optimism or pessimism, and maintain a balanced view of market conditions and risks.

- Conduct Comprehensive Risk Assessments: Before making financial or investment decisions, carefully assess the potential risks involved. Consider factors such as leverage, market volatility, and historical patterns to develop a realistic understanding of potential outcomes.

- Diversify Investments: Spreading investments across different asset classes and sectors can help mitigate the impact of a Minsky Moment. Diversification reduces the concentration of risk and provides a cushion during market downturns.

- Stay Informed and Seek Contrarian Perspectives: Actively seek out differing opinions and perspectives. Engage in critical thinking, and consider dissenting voices that challenge prevailing market narratives. This approach helps to avoid the echo chamber effect and enables a more objective assessment of risks and opportunities.

Conclusion

The Minsky Moment serves as a vital mental model that highlights the cyclical nature of optimism and risk-taking in decision-making processes. By understanding the psychological biases that contribute to this phenomenon and adopting practical strategies to identify and avoid the Minsky Moment, individuals and organizations can make more informed decisions. Maintaining a balanced perspective, conducting comprehensive risk assessments, diversifying investments, and seeking contrarian perspectives are essential in mitigating the potential consequences of irrational exuberance. Ultimately, awareness and active avoidance of the Minsky Moment can help individuals navigate economic cycles more effectively and make decisions aligned with their long-term best interests.