Introduction

In the realm of decision-making, our minds often fall prey to cognitive biases that lead us astray from rational choices. One such cognitive bias is the Base Rates mental model. Base Rates refer to the underlying probability or prevalence of an event within a given population. Understanding this concept is crucial for making informed decisions, as it helps us avoid biases and make more objective judgments. In this blog post, we will delve into the relevance of Base Rates in decision-making processes, explore its psychological underpinnings, provide real-world examples of its occurrence, and offer practical strategies to overcome this cognitive bias.

The Relevance of Base Rates

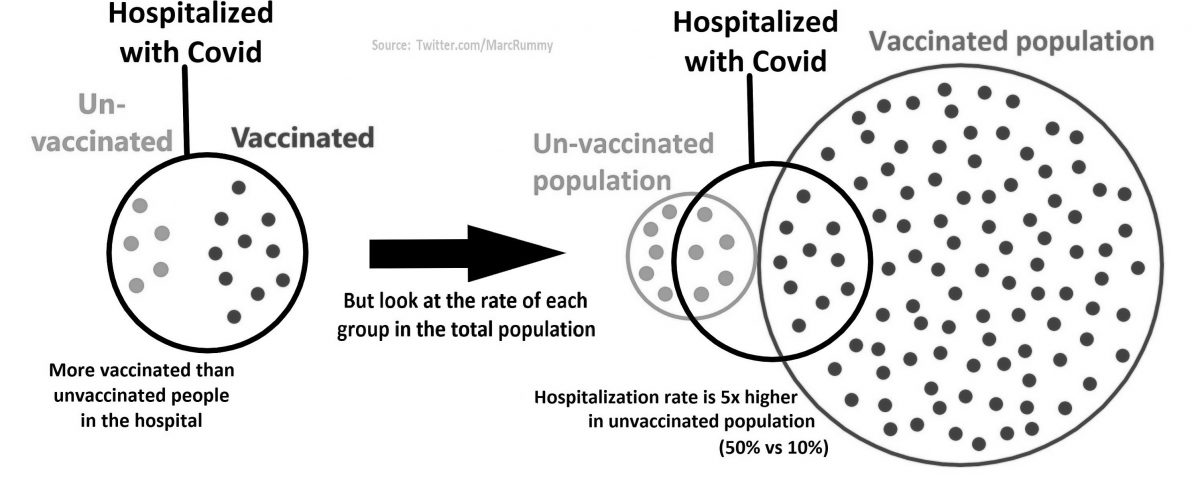

At its core, the Base Rates mental model recognizes that objective probabilities should play a central role in our decision-making process. By understanding the prevalence of an event within a larger population, we can make more accurate predictions and allocate resources efficiently. Base Rates provide a critical benchmark against which we can evaluate the relevance and significance of specific information or evidence.

Anchored in Human Psychology

The prevalence of the Base Rates mental model in our lives can be attributed to the way our minds process information. Humans often rely on mental shortcuts, or heuristics, to make judgments quickly and efficiently. While these heuristics usually serve us well, they can lead to systematic errors when dealing with statistical information. Base Rates can be easily overlooked or undervalued when we are influenced by vivid anecdotes, personal experiences, or emotionally charged narratives, which tend to have a stronger impact on our decision-making processes.

Real-World Examples

Personal Life Decisions:

Imagine an individual considering whether to invest in the stock market. They hear stories of colleagues who have made significant gains through speculative trading. However, they fail to consider the base rate that the majority of individual investors do not consistently outperform the market. By neglecting the base rate, they might make impulsive investment decisions that are contrary to their long-term financial interests.

Business Scenarios:

A startup founder is seeking funding for their innovative product. They present compelling success stories of similar startups that became billion-dollar companies. While these anecdotes may be inspiring, they fail to account for the base rate that a majority of startups fail to achieve such extraordinary success. Ignoring the base rate might lead the founder to overestimate their own chances of success, potentially resulting in poor resource allocation and unrealistic expectations.

Public Policy-Making:

Governments often face the challenge of allocating resources effectively to address public health concerns. Suppose a government decides to invest a significant portion of their budget in combating a relatively rare disease due to sensationalized media coverage and emotionally charged narratives. Neglecting the base rate of the disease’s prevalence within the overall population might result in disproportionate resource allocation, ignoring other more prevalent health issues that could have a more substantial impact on public health.

Mental Biases and Psychological Underpinnings

The Base Rates mental model is closely intertwined with several cognitive biases, including the availability heuristic and confirmation bias. The availability heuristic leads us to make judgments based on the ease with which relevant examples come to mind. Confirmation bias further reinforces these judgments by selectively seeking or interpreting information that confirms our preconceived notions.

Moreover, humans tend to prioritize immediate and vivid information over abstract statistical data, a phenomenon known as the affect heuristic. Emotional responses often override rational analysis, causing individuals to neglect base rates and rely on anecdotal evidence or personal experiences instead.

Identifying and Overcoming Base Rates Fallacy

Recognize the Influence of Anecdotes:

Be aware of how vivid anecdotes or personal experiences can skew your judgment. When facing a decision, consciously remind yourself to consider the base rate and seek statistical data or expert opinions to provide a broader perspective.

Analyze Historical Data:

Utilize historical data, studies, or industry reports to understand the base rates of relevant events or outcomes. By grounding your decision-making process in objective probabilities, you can make more informed choices.

Seek Diverse Perspectives:

Engage in open discussions and actively seek out diverse perspectives. By considering alternative viewpoints, you can reduce the impact of cognitive biases and gain a more accurate understanding of base rates.

Embrace Bayesian Thinking:

Adopt a Bayesian mindset by updating your beliefs and decisions as new evidence emerges. Continually reassess the base rate and adjust your judgment accordingly to improve the accuracy of your decision-making.

Conclusion

The Base Rates mental model provides a framework for making more objective and informed decisions. By recognizing the prevalence of an event within a population, we can avoid the pitfalls of cognitive biases and make rational choices. Throughout our personal lives, business endeavors, and public policy-making, understanding base rates is crucial for allocating resources efficiently, managing risks effectively, and achieving better outcomes. By being aware of our biases, considering statistical evidence, and embracing a Bayesian mindset, we can navigate the complexities of decision-making with greater clarity and objectivity. Let us strive to free ourselves from the shackles of biased thinking and embrace the power of the Base Rates mental model.