Introduction

In the realm of decision-making, the concept of Regulatory Capture plays a significant role in shaping outcomes and policies. Regulatory Capture refers to a phenomenon in which regulatory agencies, originally established to protect the public interest, gradually come to be influenced or controlled by the industries they are supposed to oversee. This mental model is anchored in human psychology and has far-reaching implications in our day-to-day lives. In this blog post, we will explore the relevance of Regulatory Capture in decision-making processes, its prevalence in various contexts, and the detrimental effects it can have on individual, business, and public interests.

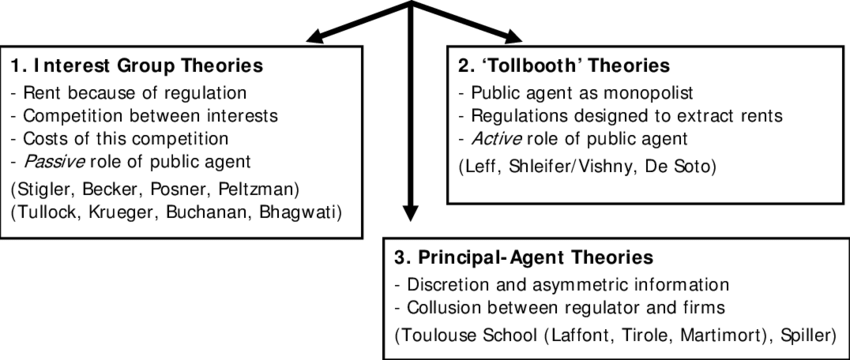

Understanding Regulatory Capture

Regulatory Capture occurs when a regulatory body, such as a government agency, becomes excessively influenced or co-opted by the industry it is intended to regulate. Rather than acting in the best interests of the public, the regulatory agency starts serving the interests of the industry it is supposed to oversee. This phenomenon can manifest in various ways, including undue industry influence on policy decisions, preferential treatment, and regulatory capture through revolving door dynamics.

The Psychology of Regulatory Capture

Regulatory Capture finds its roots in several psychological factors and biases. One key factor is the psychological principle of reciprocity, where individuals feel compelled to reciprocate favors or benefits received. Industries often use this principle to establish relationships with regulatory agencies, leading to a bias towards accommodating industry interests.

Confirmation bias also plays a significant role in Regulatory Capture. Individuals within regulatory agencies may develop a bias towards information that aligns with their preconceived notions or the industry’s narrative. This bias can result in a skewed interpretation of evidence, leading to decisions that favor industry stakeholders.

Examples of Regulatory Capture in Decision-Making

Personal Life Decisions:

Consider a scenario where an individual is deciding whether to invest in a particular financial product. The financial industry’s marketing efforts, including misleading advertisements and persuasive sales tactics, can influence the individual’s decision. By succumbing to Regulatory Capture, the person may be swayed by the industry’s narrative rather than conducting an objective assessment of the product’s risks and benefits.

Business Scenarios:

In business, Regulatory Capture can occur when companies exert influence over regulatory agencies to shape policies and regulations in their favor. For example, large pharmaceutical companies may lobby regulatory bodies to delay the approval of generic drugs, allowing them to maintain a monopoly and limit competition. Such capture undermines fair market practices and hampers innovation.

Public Policy-Making:

Regulatory Capture is particularly evident in public policy-making, where powerful interest groups can wield disproportionate influence. For instance, energy companies may exert influence over energy regulatory agencies to weaken environmental regulations or secure subsidies, even if those actions are detrimental to the public’s long-term interests.

Mental Biases and Underpinnings

Regulatory Capture is facilitated by cognitive biases such as the confirmation bias, anchoring bias, and the availability heuristic. These biases contribute to the favoritism shown towards industry interests and the reluctance to consider alternative viewpoints or evidence that contradicts industry narratives. Additionally, the influence of lobbying and campaign financing further exacerbates the problem, amplifying the power of special interests in shaping regulatory decisions.

Identifying and Avoiding the Traps of Regulatory Capture

To guard against the pitfalls of Regulatory Capture, it is crucial to adopt strategies that promote objective decision-making:

Enhance transparency and accountability: Promote transparency in the interactions between regulatory agencies and industries. Robust disclosure requirements and conflict-of-interest guidelines can help identify and mitigate undue influence.

Foster an independent regulatory environment: Establish safeguards to ensure the independence of regulatory bodies. This includes enforcing strong ethics rules, minimizing revolving door dynamics between industries and regulatory agencies, and providing adequate resources to regulatory agencies to resist external pressures.

Encourage public participation: Engage the public in the decision-making process by soliciting diverse perspectives and public input. This can help counterbalance the influence of special interests and ensure decisions reflect the broader public interest.

Promote expertise and diversity: Ensure regulatory agencies are staffed with experts from diverse backgrounds who can provide independent analysis and perspectives. By cultivating a diverse and knowledgeable workforce, regulatory agencies can resist undue industry influence and make more informed decisions.

Conclusion

Regulatory Capture poses a significant challenge to effective decision-making, as it compromises the integrity of regulatory processes and undermines the public interest. By understanding the psychological underpinnings of Regulatory Capture, recognizing its occurrence in personal, business, and public policy decisions, and implementing strategies to avoid its influence, we can protect against undue industry control and preserve fair and effective regulations. Awareness and active avoidance of the mental trap of Regulatory Capture are crucial in maintaining the integrity of regulatory systems and promoting decisions that truly serve the best interests of society.