Introduction

In the intricate landscape of decision-making, the mental model of mental accounting holds a crucial role. Mental accounting refers to the tendency of individuals to compartmentalize and assign different values to money, resources, and investments based on subjective factors. Anchored in human psychology, this mental model sheds light on how our financial and non-financial decisions are influenced by how we mentally categorize and allocate resources. This blog post explores the concept of mental accounting, its relevance in decision-making processes, its prevalence in our daily lives, examples of mental accounting in personal life decisions, business scenarios, and public policy-making, the mental biases contributing to this fallacy, strategies to identify and avoid succumbing to mental accounting, and the implications of awareness and active avoidance of this mental trap.

Defining Mental Accounting and Its Relevance in Decision-Making

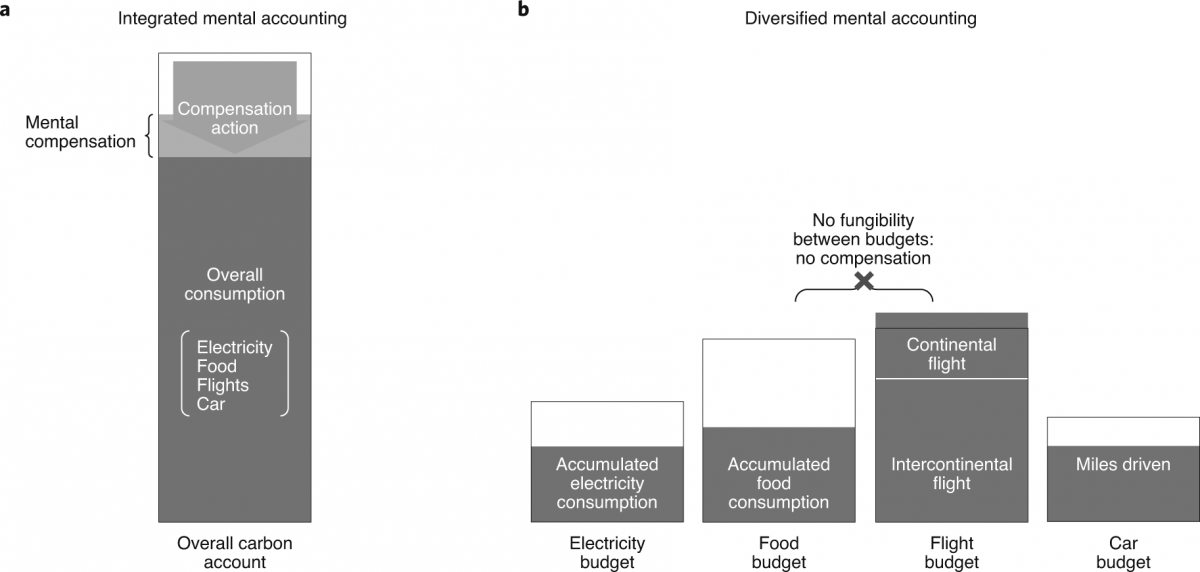

Mental accounting refers to the cognitive process of categorizing resources, such as money or time, into different mental accounts based on subjective criteria. Each mental account has its own set of rules, values, and purposes, which influence decision-making regarding how these resources are allocated and spent. The relevance of mental accounting in decision-making lies in its influence on our perception of value, risk, and utility. It shapes our choices regarding savings, investments, spending habits, and resource allocation, often leading to irrational decisions that are contrary to our best interests.

Anchoring Mental Accounting in Human Psychology and Its Prevalence in Everyday Life

Mental accounting is deeply rooted in human psychology, particularly in our need for cognitive shortcuts and our tendency to categorize and compartmentalize information. We assign emotional and subjective significance to different mental accounts, impacting our decision-making processes. In our day-to-day lives, mental accounting manifests in various contexts, from personal life decisions to business scenarios and public policy-making.

Examples of Mental Accounting in Different Contexts

- Personal Life Decisions: Consider a person who receives a tax refund and mentally accounts for it as “free money” separate from their regular income. They may be more inclined to spend it on discretionary items rather than allocating it towards savings or debt repayment. By mentally categorizing the tax refund as separate from their overall financial situation, they make a decision that may not align with their long-term financial goals.

- Business Scenarios: In business, mental accounting can influence investment decisions. For example, a company may allocate a significant budget for marketing initiatives but be hesitant to invest in employee training programs. They may mentally account for marketing as a necessary expense to drive revenue, while training is seen as an optional cost. This biased allocation can hinder the company’s long-term growth potential and employee development.

- Public Policy-Making: Mental accounting also plays a role in public policy-making. Governments often allocate resources to different areas based on separate mental accounts. For instance, funding for education may be seen as distinct from funding for healthcare or infrastructure. This siloed approach to resource allocation may overlook the interdependencies and interconnectedness of societal needs, leading to suboptimal policy outcomes.

Mental Biases and Psychological Underpinnings of Mental Accounting

Several mental biases contribute to the phenomenon of mental accounting. One such bias is the endowment effect, where individuals assign higher value to resources they possess than identical resources they do not possess. This bias leads to a discrepancy in the perceived value of resources across different mental accounts and influences decision-making accordingly.

The sunk cost fallacy is another bias that interplays with mental accounting. It occurs when individuals consider past investments (financial or otherwise) as relevant in their decision-making process, even when those costs are irrevocable. Mental accounting can intensify the impact of sunk costs, as individuals tend to allocate the burden of those costs to specific mental accounts, making it harder to let go and make rational decisions.

Practical Strategies to Avoid Succumbing to Mental Accounting

- Integrate Mental Accounts: Instead of viewing resources in isolation, strive for a holistic perspective. Integrate mental accounts and consider the overall impact of resource allocation on your long-term goals. Recognize that money or time is fungible, and decisions in one mental account can have implications on others.

- Challenge Mental Categories: Question the arbitrary divisions created by mental accounts. Challenge the assumptions and rules you have assigned to different accounts. Consider how a resource allocated to one account could be better utilized in another, aligning with your broader objectives.

- Focus on Value and Utility: Instead of solely relying on mental accounts, assess the value and utility of resources objectively. Consider the opportunity cost of decisions, evaluating the potential benefits across different accounts. This approach helps in making more informed and balanced choices.

- Seek External Perspectives: Engage in discussions with trusted individuals who can provide an objective viewpoint on your financial or resource allocation decisions. Seek advice from financial advisors or professionals who can offer an unbiased perspective and help you avoid the pitfalls of mental accounting.

Conclusion

Mental accounting is a prevalent and influential mental model that impacts decision-making in various aspects of life. By understanding its concepts, examples, and psychological underpinnings, individuals can identify when they are susceptible to the biases of mental accounting. Through practical strategies like integrating mental accounts, challenging mental categories, focusing on value and utility, and seeking external perspectives, individuals can make more objective decisions aligned with their long-term goals. Awareness and active avoidance of the mental accounting fallacy empower individuals to navigate decision-making with clarity, ensuring their resources are allocated wisely and in their best interests.