Introduction

In the realm of decision-making, our thought processes are often influenced by various mental models. One such intriguing concept is Ergodicity, a mental model deeply rooted in human psychology. Ergodicity refers to the assumption that time-averaged behavior in a system is representative of individual behavior within that system. This model holds significant relevance in decision-making processes as it affects our perception of risk, probabilities, and long-term outcomes. By understanding the impact of Ergodicity on our daily lives, we can make more informed decisions. In this blog post, we will explore the concept of Ergodicity, examine its prevalence in personal, business, and public policy decisions, discuss the cognitive biases that contribute to its occurrence, offer practical strategies to identify and mitigate Ergodicity, and emphasize the value of awareness in decision-making.

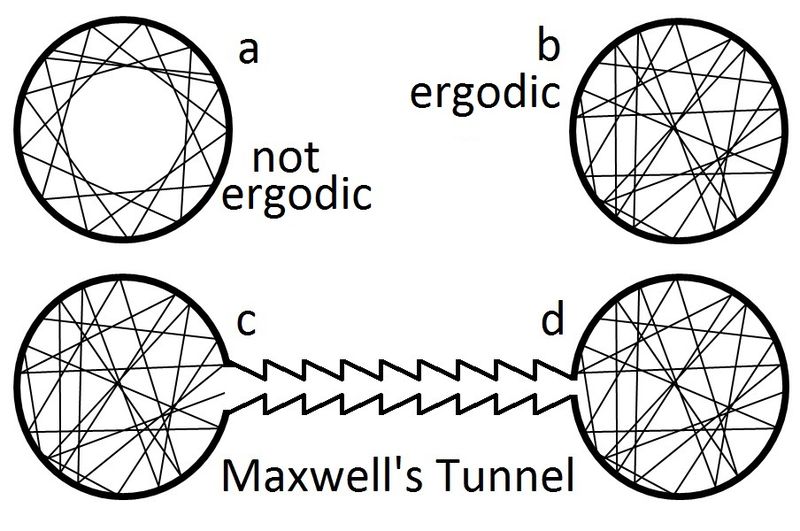

Understanding Ergodicity: The Assumption of Time-Averaged Behavior

Ergodicity is based on the assumption that the average outcomes observed over time in a system reflect the individual experiences within that system. It assumes that the long-term average behavior of a process is representative of what an individual might experience if they were to repeat the process multiple times. This mental model often leads individuals to make decisions based on time-averaged probabilities rather than considering the potential variability in outcomes that can occur in real-world situations.

Examples of Ergodicity in Various Contexts

- Personal Life Decisions: Consider an individual who invests all their savings in a single high-risk investment. They assume that the long-term average return will compensate for short-term losses. However, by solely relying on the time-averaged behavior, they neglect the possibility of a significant loss that could have a detrimental impact on their financial well-being. This failure to account for the potential variability in outcomes demonstrates the influence of Ergodicity.

- Business Scenarios: In business, Ergodicity can manifest when a company decides to allocate its resources based solely on long-term average market trends. For example, a retail chain might open new stores in locations where the average sales performance is promising. However, by ignoring the variability in individual store performance and failing to consider potential outliers, the company may face unforeseen challenges and losses.

- Public Policy-Making: Ergodicity can affect public policy decisions, particularly when planning for social welfare programs. A government might base its policies on the average income or unemployment rates across the population, assuming that the long-term averages reflect individual experiences. However, this overlooks the fact that some individuals may experience prolonged periods of unemployment or live in poverty, leading to policies that inadequately address the needs of specific segments of the population.

Mental Biases and Psychological Underpinnings

Several cognitive biases contribute to the prevalence of Ergodicity

- Availability Bias: Our tendency to rely on readily available information when making decisions can reinforce Ergodicity. We may give more weight to long-term averages or general trends that are easily accessible, overlooking the potential variability in outcomes.

- Gambler’s Fallacy: This bias occurs when individuals believe that past outcomes will influence future outcomes in a random process. The fallacy leads them to make decisions based on time-averaged behavior, assuming that the system will “balance out” over time.

- Outcome Bias: This bias refers to the tendency to judge the quality of a decision based on the outcome rather than the decision-making process itself. When outcomes align with the time-averaged probabilities, individuals may mistakenly believe that their decision-making approach was valid.

Practical Strategies to Identify and Mitigate Ergodicity

To avoid falling prey to Ergodicity, individuals can employ the following strategies

- Consider Variability: Recognize that long-term averages do not necessarily represent individual experiences. Evaluate the potential range of outcomes and assess the impact of outliers or extreme events.

- Embrace Scenario Analysis: Instead of relying solely on long-term averages, simulate different scenarios to understand the potential variability in outcomes. Consider the impact of both positive and negative outliers to gain a more comprehensive view.

- Diversify and Hedge: Spread risk by diversifying investments or actions, acknowledging that variability exists within a system. By hedging against potential extreme events, individuals can mitigate the negative consequences of relying solely on time-averaged behavior.

- Be Mindful of Biases: Cultivate awareness of cognitive biases that contribute to Ergodicity. Regularly question assumptions, challenge available information, and seek a more nuanced understanding of probabilities and outcomes.

Conclusion

Ergodicity, the mental model assuming that time-averaged behavior reflects individual experiences, significantly influences decision-making processes. Anchored in human psychology, Ergodicity can lead to irrational decisions when individuals overlook the variability and potential outliers in outcomes. By recognizing the prevalence of Ergodicity and understanding the biases that contribute to its occurrence, individuals can adopt strategies such as considering variability, scenario analysis, diversification, and mindfulness of biases to make more objective decisions. Developing awareness and actively avoiding the mental trap of Ergodicity can empower individuals to navigate uncertainty and maximize their long-term outcomes.