Introduction

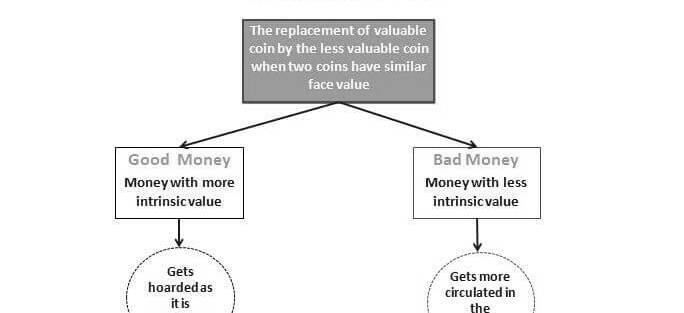

In the realm of decision-making, there exists a mental model known as Gresham’s Law. Coined by economist Sir Thomas Gresham in the 16th century, this concept states that bad money tends to drive out good money from circulation. Gresham’s Law highlights how individuals and societies, driven by self-interest, often prioritize inferior or counterfeit currency over higher-quality money, leading to detrimental outcomes. This mental model is deeply rooted in human psychology and finds prevalence in our day-to-day lives. In this blog post, we will explore the relevance of Gresham’s Law in decision-making, examine examples across personal, business, and public policy contexts, delve into the mental biases that contribute to this phenomenon, and offer practical strategies to avoid succumbing to this mental trap.

The Essence of Gresham’s Law

Gresham’s Law revolves around the basic premise that individuals tend to hoard or spend inferior currency while using or circulating higher-quality money. This behavior stems from the desire to maximize personal gain and protect one’s interests. Over time, this preference for bad money results in the withdrawal or devaluation of good money from circulation, leading to negative consequences for individuals, businesses, and economies.

Examples of Gresham’s Law

Personal Life Decisions:

In personal finance, Gresham’s Law can be observed when individuals prioritize accumulating debt with high interest rates over saving or investing their money. The temptation to spend freely using credit cards or loans with unfavorable terms, while neglecting prudent financial planning, can lead to a cycle of indebtedness. By favoring the short-term benefit of immediate consumption, individuals unwittingly undermine their long-term financial well-being.

Business Scenarios:

In the realm of business, Gresham’s Law manifests when companies prioritize short-term gains at the expense of long-term sustainability. For instance, an organization may cut corners in product quality to reduce costs and increase profits in the short run. By doing so, they risk damaging their reputation and losing customers who prefer higher-quality products. The pursuit of immediate gains through inferior offerings can lead to the erosion of brand value and loss of market share.

Public Policy-Making:

Gresham’s Law is also evident in public policy-making. Governments may resort to printing excessive amounts of currency to finance their spending needs, resulting in inflation and devaluation of the national currency. In response, individuals may opt to hoard or use foreign currencies or stable assets like gold as a store of value, undermining trust in the domestic currency. The preference for a more stable medium of exchange can perpetuate a vicious cycle, exacerbating economic instability.

Mental Biases and Underpinnings

Gresham’s Law is intertwined with various mental biases that influence decision-making. One such bias is the “loss aversion” bias. Humans tend to be more sensitive to losses than gains and seek to avoid perceived losses at all costs. In the context of Gresham’s Law, individuals may favor inferior money to preserve their higher-quality money, fearing the loss of value or scarcity of the latter.

Another contributing factor is the “status quo bias.” Individuals often exhibit a preference for the familiar or existing state of affairs. When it comes to currency, people are inclined to stick with what they know and are comfortable with, even if it is of lower quality. This bias can prevent individuals from embracing innovative or superior forms of money, perpetuating the dominance of inferior currency.

Additionally, cognitive biases such as the “anchoring effect” and the “herd mentality” play a role in Gresham’s Law. The anchoring effect occurs when individuals rely heavily on the initial information they receive. In the context of currency, this bias can lead individuals to anchor their perception of value to the nominal or face value of money, disregarding its true worth. The herd mentality, on the other hand, drives individuals to follow the crowd’s behavior, even if it may not be rational. When others hoard or use bad money, individuals may feel compelled to do the same to avoid being left out or facing potential disadvantages.

Identifying and Avoiding Gresham’s Law

To avoid falling into the trap of Gresham’s Law, it is crucial to develop an awareness of its manifestations. Here are some strategies to help individuals make more objective decisions:

Education and Research: Invest time in understanding the characteristics, benefits, and drawbacks of different forms of currency or financial instruments. Stay informed about economic developments, policy changes, and the impact they may have on different types of money.

Long-Term Perspective: Adopt a broader perspective when making financial decisions. Consider the potential consequences and trade-offs of prioritizing short-term gains over long-term stability and prosperity. Strive to strike a balance between immediate needs and future financial well-being.

Diversification: Spread risk by diversifying assets and currencies. By holding a mix of currencies, including stable and high-quality forms of money, individuals can reduce their exposure to the risks associated with a single currency or form of money.

Conclusion

Gresham’s Law serves as a reminder of the human tendency to favor inferior options over superior ones, often driven by self-interest and short-term gains. Its prevalence in personal decisions, business scenarios, and public policy-making highlights the need for awareness and vigilance. By understanding the mental biases that contribute to Gresham’s Law and adopting strategies for objective decision-making, individuals can navigate this mental trap and make choices that align with their long-term well-being. The key lies in education, taking a long-term perspective, and diversifying one’s assets and currencies. Through proactive measures, we can avoid the pitfalls of Gresham’s Law and strive for more rational and advantageous decision-making in our financial lives.