Introduction

Black Swan events, a captivating mental model, refer to rare, unpredictable, and high-impact events that have significant consequences. This concept is crucial in decision-making processes as it challenges our ability to anticipate and plan for extreme and unexpected occurrences. Anchored in human psychology, the prevalence of Black Swan events in our day-to-day lives necessitates a deep understanding of their implications. By exploring real-life examples across personal life decisions, business scenarios, and public policy-making, we can uncover how individuals and groups often make irrational choices that neglect the existence and potential impact of Black Swan events. Understanding the associated mental biases and psychological underpinnings, as well as implementing practical strategies, is essential for identifying and mitigating the risks associated with this fallacy.

Defining Black Swan Events and Their Relevance in Decision-Making

Black Swan events, a concept popularized by Nassim Nicholas Taleb, are characterized by their extreme rarity, severe impact, and retrospective predictability. These events are typically unforeseen, and their consequences reshape the course of events in unexpected ways. In decision-making processes, understanding and accounting for Black Swan events is critical to avoid detrimental outcomes and improve risk management. While it is impossible to predict specific Black Swan events, recognizing their potential existence and impact allows for more resilient decision-making in the face of uncertainty.

Occurrence of Black Swan Events in Various Contexts

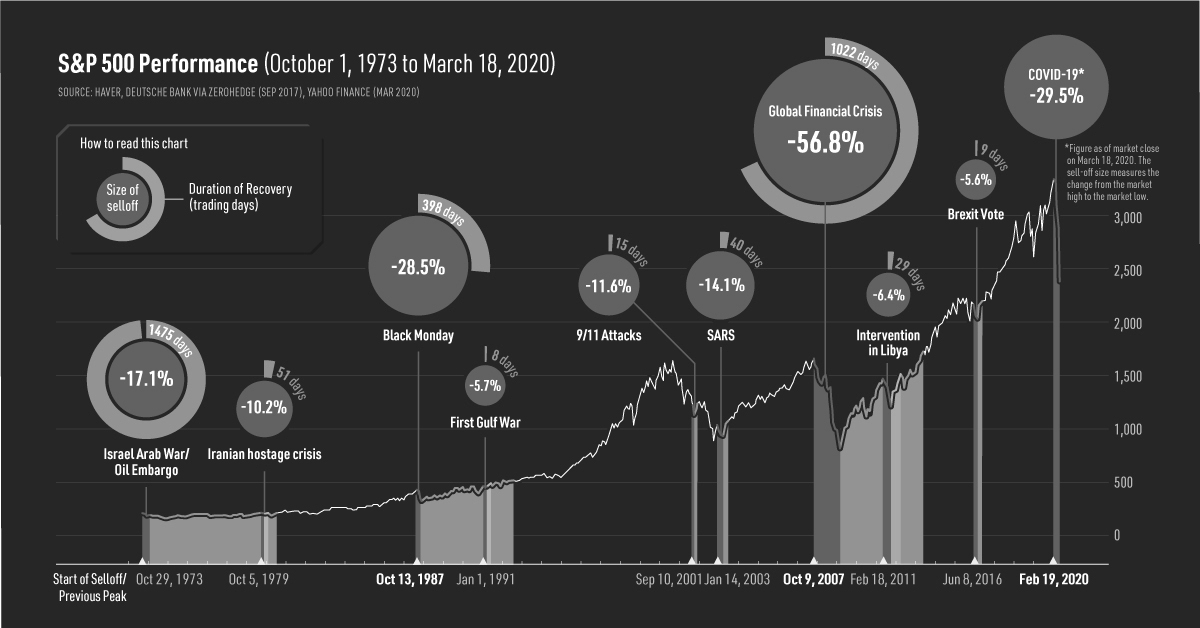

- Personal Life Decisions: Imagine an individual planning their retirement savings based on historical market trends and economic forecasts. A Black Swan event, such as a global financial crisis or a pandemic, can disrupt financial markets and jeopardize retirement plans. By failing to consider the possibility of such events, individuals may make irrational decisions, overestimating future stability and risking their financial well-being.

- Business Scenarios: In the business world, Black Swan events can profoundly impact companies. For example, the sudden emergence of a disruptive technology or a natural disaster can render existing business models obsolete or cause significant financial losses. Failure to account for the possibility of such events can lead to strategic missteps, missed opportunities, and even bankruptcy.

- Public Policy-Making: Black Swan events also shape public policy-making. For instance, in the context of climate change, failure to address the potential occurrence of extreme weather events can lead to inadequate infrastructure planning and disaster management. By neglecting the potential impact of Black Swan events, policymakers may make decisions that leave societies vulnerable to significant harm and economic disruptions.

Mental Biases and Psychological Underpinnings

Several biases contribute to the overlooking or underestimation of Black Swan events. The Availability Heuristic bias leads individuals to rely heavily on information that is readily available or easily recalled, often overlooking low-probability events. The Confirmation Bias reinforces pre-existing beliefs and discourages individuals from seeking contradictory evidence or considering alternative scenarios. The Optimism Bias causes individuals to be overly optimistic about the future, disregarding the potential for extreme events. These biases collectively contribute to a failure to anticipate and adequately prepare for Black Swan events.

Identifying and Mitigating the Black Swan Events Trap

To avoid falling into the trap of neglecting Black Swan events, it is crucial to adopt a proactive and risk-aware mindset. Here are some practical strategies:

- Embrace Scenario Planning: Consider multiple plausible scenarios, including extreme and unexpected events, in decision-making processes. Develop contingency plans and stress-test strategies against a range of potential outcomes.

- Diversify and Build Resilience: Emphasize diversification in personal investments or business operations to mitigate the impact of Black Swan events. By spreading risks across different assets or strategies, individuals and organizations can better withstand unexpected shocks.

- Foster a Culture of Critical Thinking: Encourage open dialogue, diverse perspectives, and challenge assumptions within decision-making processes. By actively seeking opposing views and engaging in rigorous analysis, individuals and groups can identify blind spots and better prepare for the unexpected.

The Implications and Value of Awareness

Black Swan events remind us of the inherent uncertainty in our complex world and the need for humility in decision-making. By acknowledging their existence, understanding associated biases, and actively seeking strategies to mitigate risks, we can make more informed choices. Developing an awareness of Black Swan events enables us to anticipate and respond to uncertainties with agility, resilience, and adaptability.

Conclusion

Navigating the landscape of decision-making requires acknowledging the existence and potential impact of Black Swan events. By comprehending the concept’s definition, examining real-life examples, understanding underlying biases, and adopting practical strategies, individuals and organizations can improve their decision-making processes. Embracing the value of awareness and actively avoiding the Black Swan events trap empowers us to make more informed choices, enhance risk management practices, and thrive in an uncertain world.